24 May Here’s How You Can Assess Your Revenue Cycle Management Success With 5 Easy KPIs

The landscape of the healthcare industry is rapidly changing due to the advent of value-based reimbursement and consumerism. Therefore, knowing industry standards and comparing your revenue cycle management(RCM) performance with them has become imperative for healthcare providers and facilities to ensure their revenue cycle is operating at maximum efficiency. One way to effectively track your healthcare revenue cycle performance is by developing key performance indicators – KPIs.

RCM KPIs play a pivotal role in driving data-driven decision-making and lay the road for an optimized revenue cycle efficiency. They allow healthcare providers and facilities to track all cash points, identify industry trends, and pinpoint the right direction to ensure a steady flow of revenue streams.

The HFMA has developed 29 industry-standard metrics known as MAP (Measure, Apply, and Perform) Keys or KPIs. By comparing their RCM performance against key metrics using these KPIs, healthcare facilities and providers can lower compliance risk and revenue loss, boosting their financial health.

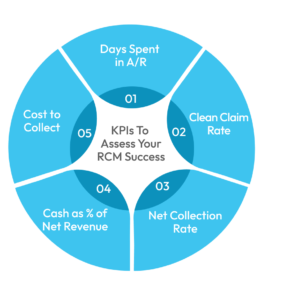

Though the efficacy of a specific KPI varies with each healthcare practice’s business goals and needs, the following 5 KPIs have helped a wide range of healthcare providers and facilities, from physicians to ambulatory surgical centers, better assess and amplify their revenue cycle management success:

Days Spent in A/R

The days spent in A/R represent the average time it takes a healthcare provider or medical facility to collect payment for their services. The lower the days spent in A/R, the faster you are getting paid; thus, this KPI helps determine a provider/facility’s effectiveness in procuring payments and managing its Accounts Receivables.

To track this metric, you first need to calculate your average daily charges. That information stems from the practice’s balance sheet and income statement. Let’s say you want to evaluate days in A/R for a quarter: add the daily charges for a three-month period and divide the sum by the total number of days in that period. Another way to find the average daily charges is to divide your annual sales by 365 – the number of days in a year. Next, divide your total receivables by the computed average daily charges, and you get the days spent in A/R.

According to the benchmark set by MGMA, the days spent in A/R should be less than 40 for maximum revenue cycle efficiency. Ideally, 95% of your payments should be procured in 40 days. If the value of days spent in A/R exceeds this number, it suggests that there is room for improvement in your revenue cycle.

Tracking this metric helps healthcare providers/organizations forecast income during any timeframe of the year and incur reasons for delayed payments, helping them further evaluate the success of their revenue cycle.

Clean Claim Rate

The clean claim rate, or the first pass resolution rate (FPRR), measures the number of insurance claims successfully reimbursed upon the first submission. Measuring this KPI allows healthcare providers to track the efficiency and identify any issues existing in their claim submission and processing process.

To measure your clean claim rate, divide the number of claims resolved on the first submission by the total number of claims resolved in the same timeframe. The ideal benchmark for this metric, according to MGMA, is 90% or higher. Your practice should succeed in resolving more than 90% of claims upon the first submission without facing any objections from the insurance company to achieve maximum productivity.

Submitting clean claims is integral to achieving a smooth revenue cycle. When claims are not resolved on the initial submission, it results in significant rework, which takes a lot of work and might even yield extra charges for the provider. The longer it takes to resolve claims after the first submission, the longer it takes to collect payments. Thus, a high clean claim rate indicates that A/R is efficiently managed, and the minimum time is taken for the provider to get compensated.

Net Collection Rate

The net collection rate measures the effectiveness of a healthcare provider/facility in collecting all legitimate reimbursements. It reveals the percentage of reimbursements achieved out of the total allowed reimbursements based on the practice’s contractual obligations. Tracking this KPI helps providers determine how much revenue they have collected out of the total revenue they expect to procure, which, in turn, helps them identify factors leading to revenue loss.

To calculate your net collection rate, you first need to subtract the contractual adjustments from the total charges. Then divide the payments received for a specific time period by the value calculated before.

The net collection percentage can vary due to three factors: orders, payments, and adjustments. Experts recommend adopting a 12-month rotating schedule for analysis reporting to avoid fluctuations and ensure the calculations are consistent. An overall net collection rate of 96% is an indicator of a successful revenue cycle. If the value drops below 85%, it is a sign that you need to look for outside assistance.

Cash as % of Net Revenue

The most important of all KPIs, cash as % of net revenue, measures cash performance against the opportunity for cash performance. The purpose of this KPI is to help a healthcare provider/facility understand the ability of their revenue cycle to transfer net patient services revenue to cash, which in turn helps them evaluate their practice’s financial health. Its value is increased when calculated at the Financial Class Level and allows for the team by team organizational goal alignment.

To find this KPI, you will have to pull out your balance sheet and income statement. Divide the total collected patient service cash (found on the balance sheet) by the average monthly net patient service revenue (found on the income statement). According to HFMA, some total collected patient service cash, such as safety-net, Direct Graduate Medical Education, Medicare pass-through, Medicaid DSH payments, and other patient-related settlements and payments, should be excluded when calculating this KPI.

Cost to Collect

Last but not the least, to gauge the efficiency and productivity of their revenue cycle in its entirety, healthcare providers need to track a cost to collect KPI. The HFMA has laid out the process to determine the value of this trending performance indicator:

The cost to collect should be less than or equal to 3% – according to the benchmark set by HFMA. A value higher than 5% suggests the need for a helping hand for cash containment.

Cost to collect can be calculated with or without including IT costs as revenue cycle costs do not represent major health IT costs, such as server expenses, hardware expenses, licensing fees, and any full-time equivalent staff supporting the systems. The HFMA has further added that the revenue cycle costs should exclude physical space expenses and lease and rent costs.

Where to Begin?

RCM is a complex process that begins with patient appointment scheduling and spans various post-visit tasks, such as medical coding and billing. Healthcare providers who fail to track revenue cycle metrics often face revenue leakage without knowing about it. On the other hand, those who collect, track, and trend their data to track revenue cycle metrics using KPIs can better allocate resources and improve their revenue cycle efficiency.

Healthcare providers should start the KPI journey one step at a time, so they can purposefully identify the key performance indicators that are essential for their specific business. However, navigating through the many different healthcare revenue cycle performance KPIs developed by HFMA can be daunting to do on your own. The good news is you can outsource this service! Healthcare providers around the world outsource RCM processes to companies that are better equipped at handling the many intricacies of revenue cycle management.

Sypore is also one such company that extends a helping hand spanning the entirety of revenue cycle management, from end-to-end medical billing to accounting. We carry out an extensive financial performance analysis to help healthcare providers identify their weak points while also providing recommendations on maximization opportunities. Laying out a foundational block of KPIs for healthcare providers helps them benchmark their revenue cycle’s performance with industry peers, allowing them to set goals for improvement and remain a market competitor. Ready to kickstart your journey to achieving financial success? Reach out to Sypore.

No Comments